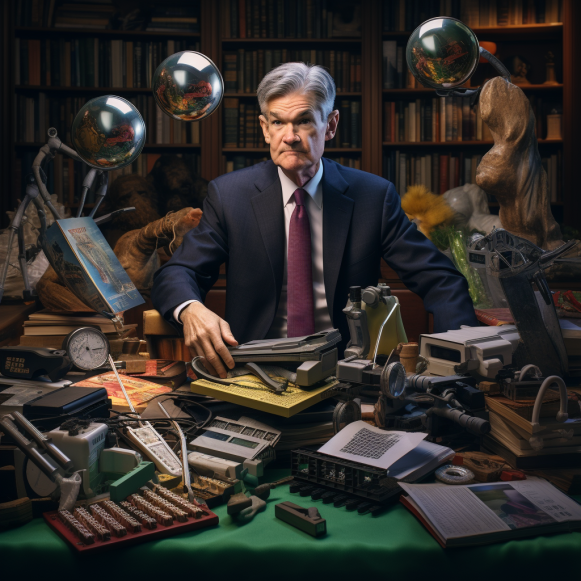

Want to know what Jerome Powell will do next? Here are the 10 academic journals the Federal Reserve pulls its inflation playbook from.

Our experts answer readers’ investing questions and write unbiased product reviews (here’s how we assess investing products). Paid non-client promotion: In some cases, we receive a commission from our partners. Our opinions are always our own.

- Monetary policy is the driving force behind today’s market, and interest rate cuts are key.

- No one knows exactly when rate cuts will take place, but academic journals may provide some insight.

- 10 academic journals have proven to be favorites among central bankers as guides for policy.

As the year comes to a close, Wall Street analysts have begun to predict how the stock market and the economy will perform in 2024.

The Federal Reserve and the monetary policy Jerome Powell will implement next year as he fights to reduce inflation to 2% is central to those forecasts. Interest rate hikes — or lack thereof — have been the primary market drivers in 2023, and the timing and extent of any interest rate cuts next year will undoubtedly have a significant impact on the market in 2024.

Some on Wall Street believe that cuts will occur sooner than others. According to UBS analysts, interest rates could be cut as early as March, with the Fed pushed to act quickly by a recession. Morgan Stanley predicts no rate cuts until June, while Goldman Sachs predicts no cuts until the fourth quarter of 2024.

Even for Wall Street experts, predicting the Fed’s next move is clearly difficult. Any insight into the Federal Reserve’s thinking could be extremely valuable for investors attempting to time the inevitable market moves that will occur in response to Fed announcements.

Fortunately, central bankers do not act in a vacuum. Their decisions are influenced by economic research from various sources, and understanding what those sources are saying can help investors better understand the Fed’s decisions before they are made.

While government data is clearly an important source of information for central bankers, academia is a lesser-known resource. Economic journals, in particular, are at the cutting edge of monetary policy theory, providing insight and guidance into a global economy experiencing unprecedented shockwaves in quick succession.

No one knows how to deal with a global pandemic, monetary stimulus, sky-high inflation, geopolitical tensions, the emergence of cryptocurrencies, the AI boom, and all the other upheavals that have occurred in the last three years, but academic research can provide central bankers with a playbook from which to draw.

Understanding which of these resources central bankers rely on can help predict future monetary policy moves. That’s why the Bank of International Settlements, or BIS, released a report late last month highlighting the academic journals from which central banks such as the Federal Reserve draw economic policy ideas.

The authors concentrated on policy relevance, which means that rather than highlighting all of the journalistic articles cited in every central bank announcement, they focused on those cited in primary central bank publications such as working papers and policy journals. That way, they could separate the signal from the noise and concentrate solely on the academic journals that are truly driving public monetary policy.

“Our ranking facilitates a more granular understanding of policy impact within the field of central banking,” the researchers wrote in their paper. “Moreover, it offers a guide to researchers who want to target policy audiences and can help central banks more generally in gauging and optimizing the policy impact of their analytical output and its evolution over time.”

The ten academic journals listed below have had the greatest influence on central bank policy, and are listed in descending order of influence.

- Economic Activity Papers from the Brookings InstitutionThe Brookings Institution is a nonpartisan think tank that conducts research on government policies. Economic studies, global economy and development, and other topics are among the research topics.

- The Quarterly Journal of Economics is a peer-reviewed economics journal.The Quarterly Journal of Economics is edited by the Department of Economics at Harvard University and published by Oxford University. It is the “oldest professional journal of economics in the English language,” with a focus on macroeconomics.

- Monetary Economics JournalThe Journal of Monetary Economics is one of the world’s most prestigious economic journals, and the BIS named it the top journal for central banking research.

- Macroeconomics, American Economic JournalRather than focusing solely on macroeconomic theory and practice, the American Economic Journal: Macroeconomics examines macroeconomics in the context of public policy, including industrial organization, labor economics, public finance, and more.

- Political Economy JournalThe Journal of Political Economy, published by the University of Chicago and regarded as “one of the oldest and most prestigious journals in economics,” focuses on theoretical economics and econometrics. American Economic Review (AER)Rather than focusing on theory or policy, the American Economic Review examines economics in a broader, more general context.

- Economic Literature JournalThe Journal of Economic Literature brings together a massive amount of economic research and analysis from around the world in one place.

- International Central Banking JournalWhile most economic journals are academic in nature, the International Journal of Central Banking was created as a compilation of central banking policy and theory by the combined efforts of several central banks.

- Economic Studies ReviewThe Review of Economic Studies, one of the big five economics journals, “aims to encourage research in theoretical and applied economics, especially by young economists.”

- International Economic JournalThe Journal of International Economics, as the name suggests, focuses on international finance, including trade patterns, commercial policy, exchange rates, and other topics.