I graduated from college in my late 30s after almost a decade in the military. Here’s why it was worth it.

Josh Rose (not pictured) graduated in May 2024 with a computer science degree. I was a pretty bad student in high school. I had stopped trying academically, so I wasn’t really college material at that time. My dad went into the military straight out of high school. I followed in his footsteps and joined the…

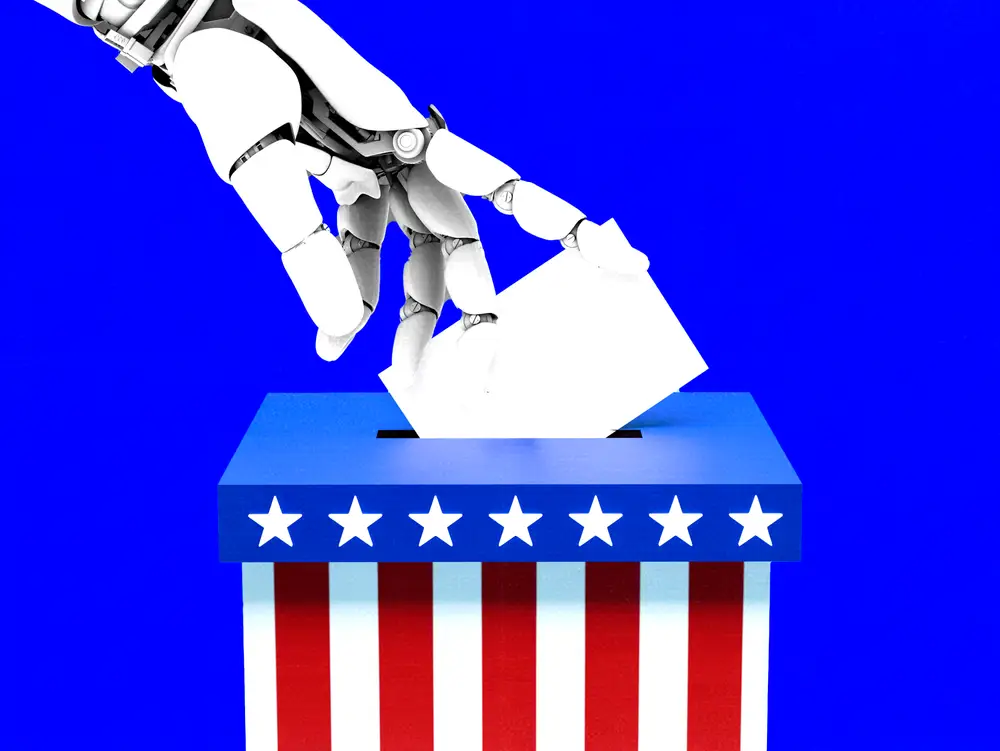

The election is a big test for AI companies like OpenAI and Perplexity

ChatGPT didn’t exist during the last presidential election in 2020. Its launch two years ago kicked off a wave of generative AI chatbots and tools integrated into popular consumer products like Google Search. Ahead of the election, the companies behind the products had to decide what restrictions, if any, they would implement on AI-generated content…

Schonfeld is leading its peers a year after the $11.6 billion firm ended tie-up talks with Millennium. How the industry’s biggest funds did in October.

Ryan Tolkin is the CEO and chief investment officer of Schonfeld Strategic Advisors. In a year full of strong months, October still stood out for Schonfeld Strategic Advisors. The $11.6 billion New York-based fund is roughly a year removed from nixing a potential takeover by its larger rival Millennium, and the manager’s strong 2024 has…

The most accurate forecasts of 2024: Seeking nominations for B-17 Oracles of Wall Street list

A 50-basis-point rate cut from the Federal Reserve. The S&P 500 rallying 20%. Shares of Nvidia soaring over 180%. Inflation returning to pre-pandemic levels. Did you or someone you know on Wall Street predict these and other significant developments in 2024? We’d like to hear from you. B-17 is seeking nominations for its 2024 Oracles…

Palantir’s record earnings juice the stock market’s AI trade ahead of the election

US stocks rose on Tuesday as investors geared up for the result of the presidential election and mulled record earnings from Palantir. Though new momentum from Harris over the weekend weighed on the Trump trade on Monday, Treasury yields, bitcoin, and Trump Media stock were all higher on Tuesday. Palantir spiked as much as 20%…

Russia’s oil revenue plummeted 29% in October amid volatile global crude prices

Russia saw a double-digit drop in oil revenue last month, hitting an important source of funds for the Kremlin amid pressure on global crude prices. Moscow’s revenue from oil-related taxes plummeted 29% year-over-year in October, from 1.48 trillion rubles to 1.05 trillion rubles, according to data from Russia’s Finance Ministry. Oil and gas proceeds, which…

Why JPMorgan says election gridlock will be the best-case scenario for stocks

Donald Trump and Kamala Harris are both courting voters in Pennsylvania Regardless of the next president, JPMorgan expects stocks to rise if the US election delivers a divided Congress. “Under either gridlock scenario, we think equities reprice higher as we clear the uncertainty, volatility decreases and hedges unwind, with investors refocusing on the Fed at…

Sales are sliding at KFC and Burger King as fast-food chains keep struggling

KFC saw same-store sales drop by 5% in the US in Q3. It’s been another tough few months for fast-food giants. McDonald’s kicked off earnings last week by reporting a drop in global sales for the most recent quarter. On Tuesday, Burger King owner Restaurant Brands International and the parent company of KFC followed in…

Parts supplier cuts thousands of jobs as Germany’s auto woes deepen

An autonomous vehicle from Schaeffler at the IAA motor show in Munich, Germany last year. Germany’s auto industry is under intense pressure — and now thousands of jobs will go at a key company in the supply chain. Auto parts supplier Schaeffler said on Tuesday it would cut about 4,700 jobs across Europe and close…