Early SpaceX workers got stuck overnight on an ocean barge with a toxic spaceship, new book reports

SpaceX’s recovery ship lifts a Crew Dragon spaceship from the Atlantic Ocean. If you think your job is exciting, try working at SpaceX in its early days. As author Eric Berger puts it, “SpaceX was not a job; it was a lifestyle.” In his first book, for example, one engineer told him about crawling inside…

The closing note of the 2024 campaign: How dare you?

From an offensive joke about Puerto Rico to garbage trucks to Mark Cuban, each campaign tried to harness outrage in the final week of the election. At the end of a rally in Wausau, Wisconsin on Monday, Sen. JD Vance of Ohio called on Americans to toughen up. “I think that we have to stop…

Stock market today: Indexes jump as Amazon lifts tech and jobs data boosts rate-cut views

US stocks jumped on Friday after the October jobs report missed economist estimates, opening the door for more rate cuts from the Federal Reserve. Major indexes rose, with the Dow Jones Industrial Average rising nearly 300 points. The Nasdaq Composite ended almost 1% higher. The US economy added 12,000 jobs in October, well short of…

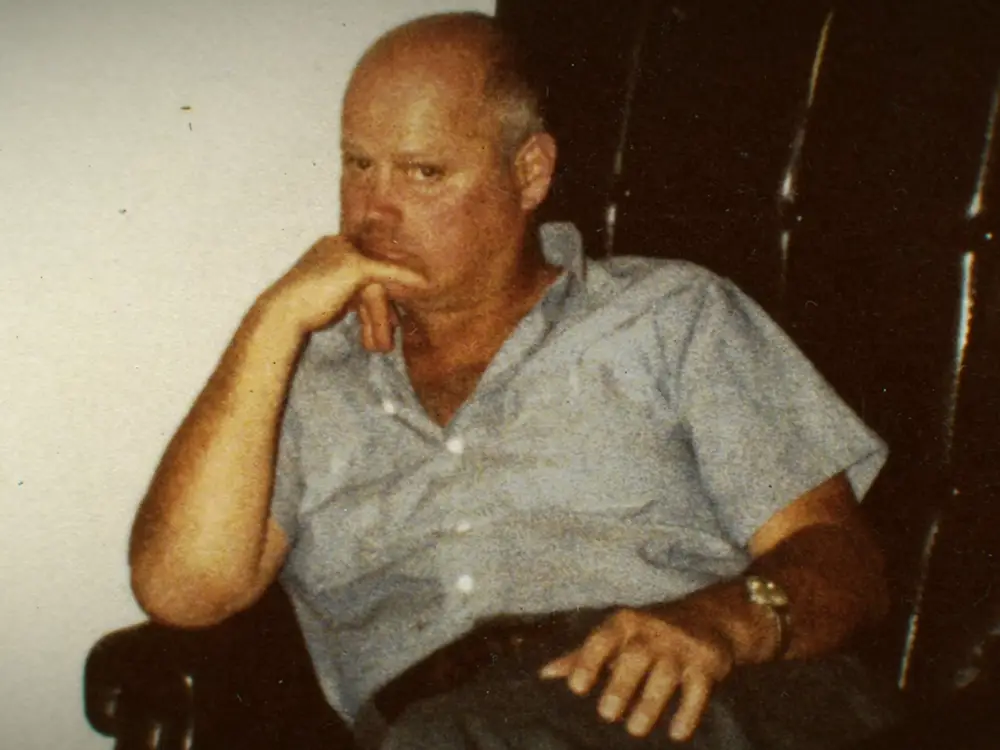

Netflix’s ‘This is the Zodiac Speaking’ tells the story of the hunt for a serial killer. Here’s what happened to murder suspect Arthur Leigh Allen.

A photograph of Arthur Leigh Allen as seen in “This Is the Zodiac Speaking.” “This is the Zodiac Speaking” examines five murders that took place in San Francisco between 1968 and 1969, which were thought to be committed by the same man. He was dubbed the Zodiac Killer because he sent letters to the police…

Millennials having fewer kids could be a drag on the economy for the next decade

Millennials aren’t having as many kids as previous generations, and that fact could end up dragging down economic growth for more than a decade. That may not faze some child-free millennials, who are using the money that would have been spent on childcare to splurge on lavish vacations, flashy boats, and other luxuries popular among…

Gwyneth Paltrow’s Goop undergoes second round of layoffs in two months

Since she launched Goop in 2008, Gwyneth Paltrow has led the company in multiple directions. Gwyneth Paltrow’s Goop has conducted its second round of layoffs in as many months, B-17 has learned. The layoffs, which accounted for less than 6% of staff, affected multiple divisions, including the beauty, programming, engineering, and creative departments. Goop confirmed…

US intel says Russian actors made the fake Georgia voter fraud video — and expects more to come

A video circulating online suggests that Haitian nationals are committing voter fraud in Georgia. But it’s all fake, US intel group says. Russian influence actors were behind the fake Georgia voter fraud video that’s been circulating online, US intelligence officials said. In a joint statement released on Friday, the Office of the Director of National…

Amillennial who decorates for Christmas early doesn’t care some people think it’s too soon. It brings her joy and peace.

Jessica Bolio started decorating her home for Christmas in October. Every November 1, Mariah Carey declares “it’s time” for the Christmas season to begin. This year, that was too late for Jessica Bolio. Bolio — a 27-year-old stay-at-home mom and content creator from Fowler, California, near Fresno — began decorating for Christmas before October was…

‘Love Is Blind’ season 8 is on the way — and 3 cast members have already been announced

“Love is Blind” season eight stars Alex, Brittany, and Joey in the audience during the season seven reunion. Season seven of the Netflix dating show “Love Is Blind” featured singles from the Washington DC area who were trying to find love. But season eight will focus more on the heart — well, the heartland. The…